Those Oil Inventories

As was previously posted(When will it end) the Oil Supply vs Demand situation has been, and is bullish for the price of oil. Let’s do a more detailed dive into the numbers to see what it tells us about the future from Those Oil Inventories circa May 2022.

Inventories

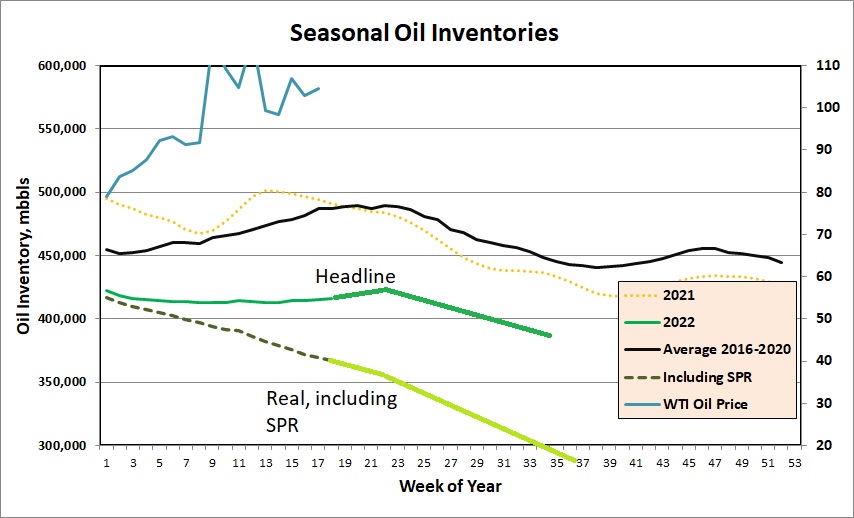

The first thing we need to understand is the impact of the releases from the US Strategic Petroleum reserve. You can see here what the inventory data looks like without considering the large inventory reductions from the SPR that the US has been undertaking since Nov of 2021. Now if we add in the withdrawals from the SPR it paints a more pessimistic picture.

As you can see here the inclusion of the SPR withdrawals shows the shortage of crude that has been apparent even with the OPEC production increases and the increase in drilling and production in the US. Also you can observe that the war in Ukraine and the Covid lockdowns in China, don’t even show up on the graphs and are probably a net zero impact on the inventories. I added on my projections of what could occur in the future with the upcoming SPR releases into the fall and the impact of peak driving season. If you ignore the SPR withdrawals inventories should be 60 million barrels down from seasonal average by the end of summer. If you include the SPR withdrawls then the “real” inventory situation will be down 160 million barrels by the end of summer, which is a bullish scenario for the price of oil.

This “real” oil production shortage is approximately 500,000 bbl/day, which doesn’t sound like much but adds up over time. If demand surges forward this summer or when China relaxes it’s Covid restrictions then the SPR release could be more than eaten up but increases in demand. If the cost of gasoline or an upcoming recession reduce demand then everything could stay balanced.

Production Forecast

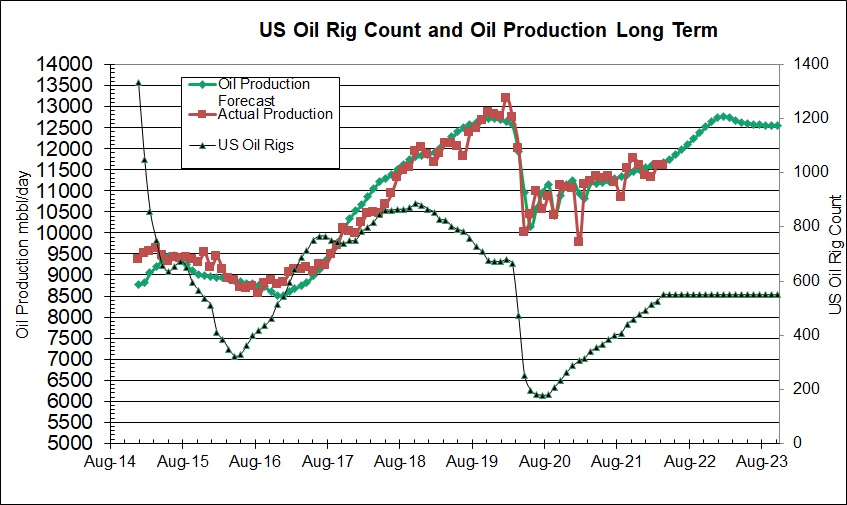

So given the inventory picture what does the forecast look like. You can go on this website to the forecast given here, but this is impacted by the DUC’s in the unconventional basins. The DUC’s, for the casual viewer, are the drilled but uncompleted wells in the shale basins of the US that were drilling but not hydraulically fractured to either hold the lease or keep the drilling rigs busy. The wells were held as an “inventory” of future production and are now being completed and put on production at a furious pace. Unfortunately at some point in time the DUC inventory will run out and this will impact the ability for the US to ramp up production. For information purposes I made a forecast that assumes the DUC completion will continue until Aug 2022 and then stop to see what the impact will be.

As you can see on this graph oil production should move up smartly this year until the DUC completion stops, and then the oil production increase will stop(given the current rig count) Although this could make up the gap in oil production observed in the inventory report, it will be close. I wouldn’t expect the drilling rig count to plateau given the pricing that companies get for their oil, but if it did then production would plateau at that level as the current drilling rate is only sufficient to maintain production, not grow it for demand growth around the world.

Conclusions

As you can see the oil market is balanced on the edge of a serious lack of supply caused by a re-opening world economy and lack of investment in the oil industry around the world. The numbers bear watching to see what happens next. It is possible that the projected surge in oil production in the US and an upcoming world recession caused by central bank tightening mean that the end of this oil cycle is imminent. Stay tuned.