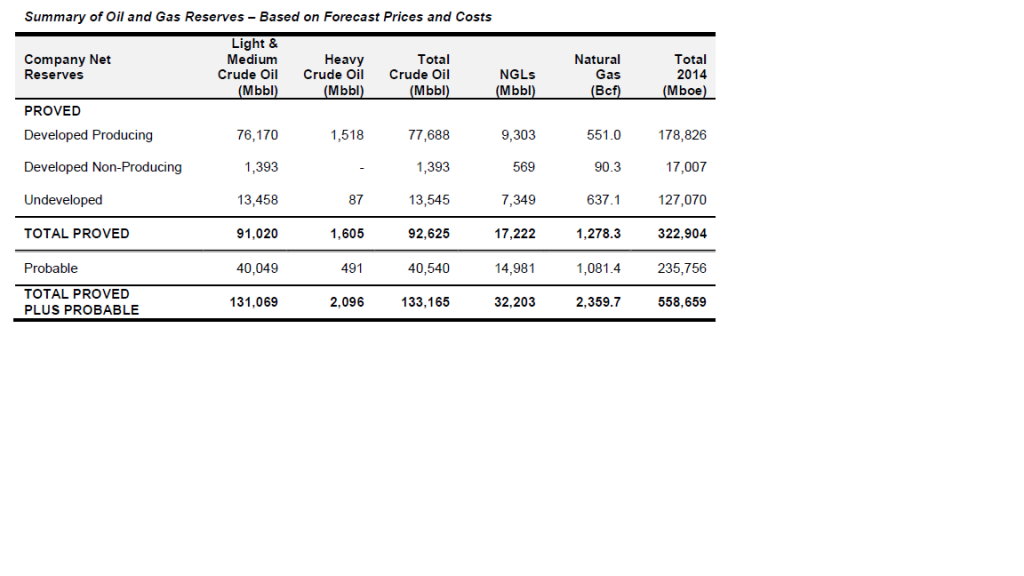

There is a lot of information in a corporate reserve report and at any time you can go and browse one but here we will look at the most relevant pieces of information in this case extracted from the Arc Resources 2014 yearend report

The categories on the rows are not descriptive to a non reserve engineer so in summary

Proved – highest confidence reserve grouping that is more likely to increase than decrease over time containing the sub categories

- Developed Producing(PDP) – This is the economically recoverable amount of hydrocarbon that can be produced from existing wells( or mines if a bitumen mine is reported on)

- Developed Non Producing(PDNP) – This is a development that will recover economic hydrocarbons in the future and is not on production. This category captures work in progress at yearend where a well is drilled and maybe completed but still needs to be connected or equipped to be produced.

- Undeveloped(PUD) – This is the amount of hydrocarbon that will be recovered from undrilled drilling locations, and that have a high confidence that they will be drilled and are economic. The reserve engineer will analyze existing wells in the formation to determine what a future well may recover. Generally not all future wells are included in PUD locations due to lack of information or distance from existing wells.

- Higher estimated recovery on existing wells

- Higher estimated recovery on the wells yet to be drilled

- Undrilled locations that were deemed higher risk or too far from existing proven production.

Terrific so now we know how much the company will produce but so what, what we really want to know is what the company is worth, after all that is the point of investing to find a place to invest our capital and have it compound over time(or speculate on a fast growing junior)

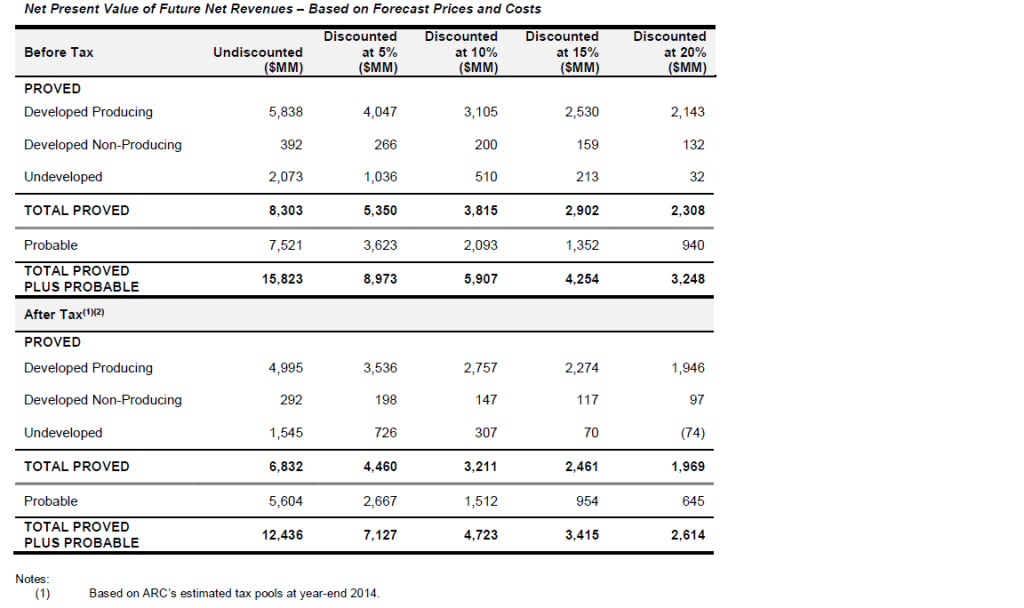

The next table that is included in the reserve report is more interesting since this is output of a discounted cash flow analysis of all the wells in the volume report while considering royalties, operating costs, taxes, forecasted prices etc.

This is much more interesting since we now know what the company reserves are worth, and for most companies(the exceptions will be covered later) the company reserves are the value of an energy producer. The categories are similar and have similar meaning so I won’t go over them again, just in this case those categories have a $ value associated with them.

If we want to know what this company is worth today with the existing wells at a 10% discount rate(this is the default discount rate used throughout this website) scanning the row for PDP(proven – developed producing) you can see that it is Cdn $2.7 Billion after tax. All you need to do then is divide by the share could and like pressing an easy button we have a rigorous corporate valuation done using a discounted cash flow methodology. But wait you say, this does not include any of the upside and the undeveloped land etc., in that case scan down to the Total Proved row and use the Cdn $3.21 Billion number or if you want the most optimistic number go to the Total Proved Plus Probable row and use Cdn $4.7 Billion.