Happy Birthday NAV Information

A belated happy birthday wish to this website and thank you to all the guests that have dropped by and looked through the pages posted here. The website is slightly more than 1 year old and we should take a moment to look at the year past and see how we are doing with the info that is presented on this website, and comment on future directions. At the end of this page is a comment section that you are welcome to fill out and send off, to make suggestions for improvements.

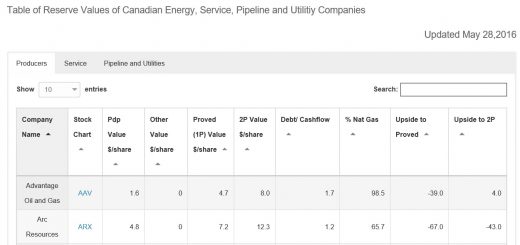

DataTable

How could we celebrate the first birthday of this website without mentioning the DataTable and all the wonderful information posted here to help you select(and reject) stocks for your portfolio. The data in this table started out with just the reserve valuation on about 20 companies and expanded to include over 58 Energy Producers, 21 Oilfield Service Companies and 20 Pipeline and Utility Companies. From the beginning the focus has been on value, trying to find the best value stocks that would survive the downturn and move higher as energy prices moved up in the recovery.

One of the first articles illustrating how to use the information here “Checking for Ideas in the Data Table“, illustrated some of the undervalued stocks on the Toronto Stock Exchange from Bankers Petroleum(taken over), Boulder Energy(taken private), Northern Blizzard(moved from $3.00 to $4.00/share) and Bonavista Petroleum(moved from $1.80/share to $4.90/share). So you can see the undervalued stocks can move up sharply, or the private market can also see great value and buy the entire company. The next article I penned was Penn West Petroleum, Great Value High Risk which highlighted this stock at $1.20/share as having great upside but much risk due to their debt to cash flow. Penn West subsequently sold a major part of their assets, paid off a substantial portion of their debt and are now on the road to recovery as a much smaller, more focused company. This illustrates how heavily indebted companies can be good value if they can realize their asset value that exists on their books by selling off the assets to pay off debt. Sadly many companies during this downturn had insufficient assets to do that and have gone out of business.

Oil Production Forecast

Right off the start I incorporated the Oil Production forecast and Oil inventory reports page as a way to gauge when the price recovery may come about. Forecasting the price of oil is difficult, but anticipating what may move the fundamentals is easier. The article What Moves the Price of Oil and Looking to the Past to Predict the future, talked to those fundamentals. Oil production had to fall to reduce bloated inventories, and OPEC has to cut production. Here at the start of 2017 it looks like OPEC has successfully cut their oil production and that has brought optimism back the oil patch for the first time in 2 years. Looking to past oil cycles, when OPEC cuts the bottom is in and the industry gradually recovers and the cycle starts all over again.

I would caution the optimism at this point due to the oil production trends in the United States, and still bloated inventories. If you have been looking at the oil production forecast page you may have noticed that my production forecast is starting to drift out of sync with the rise in production that has happened.

What has happened is that the oil drilling rig count has recovered and oil production has followed much faster than I anticipated. The new forecast is in the works, so stay tuned for when it is rolled out next week. To give a hint as what it shows, oil production is rising at due to higher rig productivity in the major shale plays in the US. Drop by next week to see the new forecast and a blog article on what has changed and why.

Market Risk Indicator

Later on the Market Risk Indicator page was added. While this is not an energy stock specific idea, it helps to monitor what is happening in the financial markets since it may help explain why your stock is going up or down. Sometimes market interest rates, banking issues etc. can dominate fundamentals and keeping an eye on this is a good idea.

Well there you have it, just a quick birthday overview. Look through the old articles, roast me for my mistakes and thank me for my good calls. If there is anything else you would like to see on this website, make a comment and I will look into it. More features will be rolled out as the ideas come to mind, or upon your avid readers suggestions. Remember the year-end 2016 reserve reports are about to be released and as the website is update we can see what good stock selection ideas can come out of this data. Stay tuned.

Not criticizing but I would roast your green shoots in the oil markets article half way through the year. Just saying. Otherwise keep it up, enjoy the site

I agree the green shoots article was a bit premature. I am more cautious in my outlook in the oil markets due to the persistent oil and products inventories. Have a look at the new oil production forecast, there is lots of oil.